| Back to Blog |

Some finer points regarding the UV Excise (tan) Tax |

|

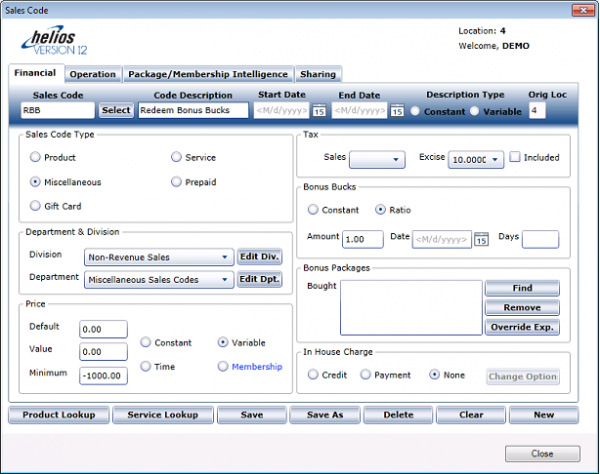

I think it will help a lot of people to have some more detailed explanations about how the tan tax works in specific situations and how the IRS performs their audit process. First, a little background. The IRS only submitted the final regulations regarding the indoor tanning tax to the Federal Register on June 11, 2013. The link is: https://www.federalregister.gov/articles/2013/06/11/2013-13876/indoor-tanning-services-excise-taxes. Up until this date the regulations under which everyone was operating were considered temporary regulations. There's no secret to how the IRS works. The IRS has also produced the tax audit technique guide which outlines how auditors can identify, calculate and recreate recordkeeping for revenue which is subject to the tan tax. The link is: http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Excise-Tax-on-Indoor-Tanning-Services-Audit-Technique-Guide. The IRS has an FAQ section specifically addressing questions relating to the tan tax. The link is: http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Excise-Tax-on-Indoor-Tanning-Services-Frequently-Asked-Questions. And now my notes: The 10% excise (tan) tax is applicable to all revenue relating to UV services. Spray tans and infrared light therapy are exempt. All product revenue is exempt from the excise tax. Excise tax exemption does not imply state sales tax exemption. Free tans can be given away under promotion and no tan tax is due as long as the practice cannot be considered a tax avoidance scheme. Giving away one free tan to a new customer is acceptable and defensible but giving away ten tans with a bottle of lotion is not. Bundling taxable and non-taxable goods and services does permit the proration of the tan tax as long as it reasonably uniform and can be defended mathematically. For example, if 10 UV tans and 2 spray tans are sold for one price, the tan tax need only be applied to the UV tans. To obtain the value of the UV tans within the bundle, the price of each component sold separately must be determined. If 10 UV tans cost $50 and 2 spray tans cost $30 but the bundle is sold for $60 and not $80 (the total if purchased separately) then the prorated tax would be $3.75. The formula is ((($50/$80)x$60)/10) in which you divide the value of the UV tans alone by the unbundled value of all included packages then multiply this by the bundled price to obtain the value of the UV tans within the bundle and then divide this by ten to get the tax amount. The Qualified Physical Fitness Facility (QPFF) exemption is unlikely to apply to any Helios users but it is only applicable if NO revenue is directly attributable to the UV services and these services are exclusively an amenity of the fitness membership. If the facility offers a separate membership which adds the tanning benefit or if they sell tanning packages or if they open the tanning services to non-members then there is attributable revenue and they lose their exemption status. Tan tax is the responsibility of the customer. If the salon does not collect the tax then it becomes the salon’s responsibility to pay the tax and it will be treated as if the price that the customer paid was ‘tax included’ which means that the price will be multiplied by 0.9091 to obtain the tax portion to be remitted. All revenue relating to UV services is tax-applicable, including EFT enrollment fees, prorate and freeze fees. It is not specified whether the tax liability of these ancillary charges are allowed to be prorated or whether eliminating them will be considered a tax avoidance scheme by the IRS. While the IRS guidelines allow for the reduction of tax liability when non-revenue rewards such as bonus bucks are applied to a taxable service, the Helios POS logic recognizes bonus bucks as a payment method which is not applied until after tax liability has already been calculated. There is also the potential for dispute in a situation in which both taxable and non-taxable items are on the same sales ticket and bonus bucks is part of a split payment situation… to which item does the bonus buck value apply, the taxable item or the non-taxable item? It opens up far too many opportunities for tax avoidance or vagueness in tax reporting that could expose salon operators to increased scrutiny during an audit. In order to reduce tax liability, users will need to utilize the Discount/Coupon feature to reduce the price of the appropriate taxable service or applicable item and the tax will be reduced accordingly. Alternatively, the creation of a Bonus Bucks Redemption sales code can be utilized which would reduce the bonus bucks value and the ticket total simultaneously.  This method does not include any security features but is auditable and is an available option. |

|

|

8001 Woodland Dr., Indianapolis, IN 46278 info@gohelios.com

Helios, LLC is a division of New Sunshine, LLC. Copyright © 2025. All Rights Reserved. indianapolis web design by: imavex